You must save your changes in order for the program to recognize the Set To Pay amount.To take the discount, select the invoice, and click the Past button instead of the Pay button. If the payment date to receive a discount has passed, Sage 100 Contractor displays past in the Discount column next to the discount amount and does not deduct the discount from the invoice balance. When you set an invoice to pay, Sage 100 Contractor deducts the available discount from the invoice balance and displays the result in the Set To Pay column. If the invoice has already been set to pay, that amount appears on the Set To Pay column. When the invoices are displayed, select an invoice and enter the amount to pay and any applicable discount. If an invoice was previously set to pay and you decided not to pay it at this time, then select the invoice, and click the No Pay button. For example, you can make partial payments to vendors and their second payees by entering a Set To Pay amount for any amount less than the stated invoice. If you do not want to pay the entire balance of the invoice, enter a different amount.

100 INVOICES FULL

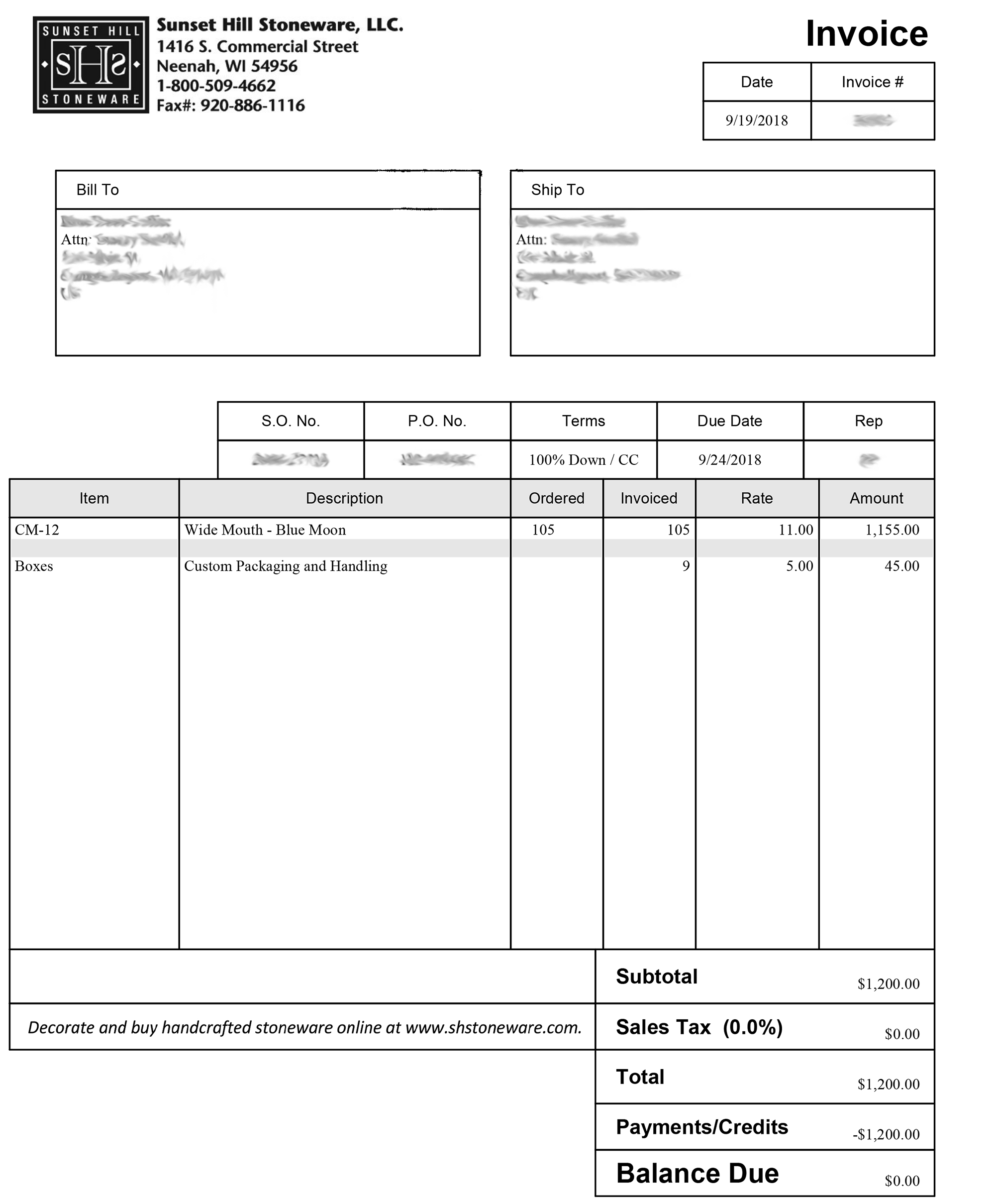

To pay the full invoice balance, select the invoice and click the Pay button. Past-Sets selected invoices to pay with a discount, even if they are past the discount date.No Pay-Removes the set to pay amount for the selected invoices.Pay-Sets selected invoices to pay their full default amount.Review-Assigns the status Review to selected invoices.Open-Assigns the status of Open to selected invoices.The window contains five buttons providing tools for working with the selected invoices. After you select the criteria and click OK, the program populates the 4-3-1 Select Invoices to Pay window with invoices. This allows you to set the criteria by which you will select invoices. When you open 4-3-1 Select Invoices to Pay, the program displays the Invoice Selection window first with the primary window in the background. This is what your customer is required to pay you.Working with 4-Accounts Payable > 4-3 Vendor Payments > About 4-3-1 Select Invoices to Pay About 4-3-1 Select Invoices to Pay Total: The total displays the balance due which is calculated from the amount of each line item on the invoice.Notes: Within the notes section of the invoice, you can stipulate any additional terms of service that you've agreed to with your customer.So please consult your local tax resource to determine how much tax you should be applying to your invoices. This rate may differ depending on the geographic location you're business operates in. Tax: Indicating the tax rate applied to the cost of the goods or services provided is legally required on invoices.The line items also require a quantity so the customer knows how many goods or services they are being billed for, the price of the line item and tax rate applied to it, and the amount the line item costs. Line Item: Each line item on an invoice should have a name for the goods or services provided, along with a description of those goods and services.And, since invoices are often due in a specified number of days after receival, the invoice date is important in showcasing when payment is due.

Invoice Date: The invoice date indicates when an invoice has been issued which helps your customers if they are receiving multiple invoices from you.

Invoice numbers can be formatted in different ways such as file numbers, billing codes or date-based purchase order numbers.

0 kommentar(er)

0 kommentar(er)